Quotes by TradingView

Secure your international

transactions with ease

Our SBLC services guarantee payment for cross-border

trade deals, quickly and efficiently.

trade deals, quickly and efficiently.

Financial instruments

Using documentary credits, also known as letters of credit, when exporting goods or services provides a secure payment mechanism for the exporter. It involves the importer’s bank issuing a written commitment to pay the exporter, subject to the fulfillment of specified conditions outlined in the credit.

Documentary credit provides importers with a reliable payment mechanism, offering peace of mind during international trade transactions. By leveraging this method, importers can confidently engage in business with exporters, knowing that payment will be made upon fulfillment of the specified conditions. This mitigates the risk of financial loss and enhances trust between parties involved in the import process.

A conventional documentary credit serves as a formal assurance of payment to the seller. It is issued with the understanding that the seller will receive payment upon submitting the required documents, adhering to the terms and conditions specified in the credit. This payment guarantee is activated once the shipment has been made, ensuring a fair and secure transaction for both the buyer and the seller in international trade.

ISP98 is a set of rules governing the use of standby letters of credit, developed by the ICC. It establishes the rights, obligations, and procedures for issuing and claiming under these instruments. Adhering to ISP98 promotes clarity, consistency, and efficiency in international trade transactions involving standby letters of credit.

- Exports

- Imports

-

Bank Guarantee, Standby

Letter of Credit (SBLC) - ISBP

- ISP98

Using documentary credits, also known as letters of credit, when exporting goods or services provides a secure payment mechanism for the exporter. It involves the importer’s bank issuing a written commitment to pay the exporter, subject to the fulfillment of specified conditions outlined in the credit.

Documentary credit provides importers with a reliable payment mechanism, offering peace of mind during international trade transactions. By leveraging this method, importers can confidently engage in business with exporters, knowing that payment will be made upon fulfillment of the specified conditions. This mitigates the risk of financial loss and enhances trust between parties involved in the import process.

A conventional documentary credit serves as a formal assurance of payment to the seller. It is issued with the understanding that the seller will receive payment upon submitting the required documents, adhering to the terms and conditions specified in the credit. This payment guarantee is activated once the shipment has been made, ensuring a fair and secure transaction for both the buyer and the seller in international trade.

ISP98 is a set of rules governing the use of standby letters of credit, developed by the ICC. It establishes the rights, obligations, and procedures for issuing and claiming under these instruments. Adhering to ISP98 promotes clarity, consistency, and efficiency in international trade transactions involving standby letters of credit.

Your financial partner

We Empower Your Business Goals with Our Comprehensive Financial Services and Instruments.

• Sustainable energy investment strategies

• Carbon offset investment advice

• Credit Enhancement

• Project finance advice

Launch your project with

our funding strategies

Supercharge your project launch with our funding expertise. Trust us to secure the resources you need for success.

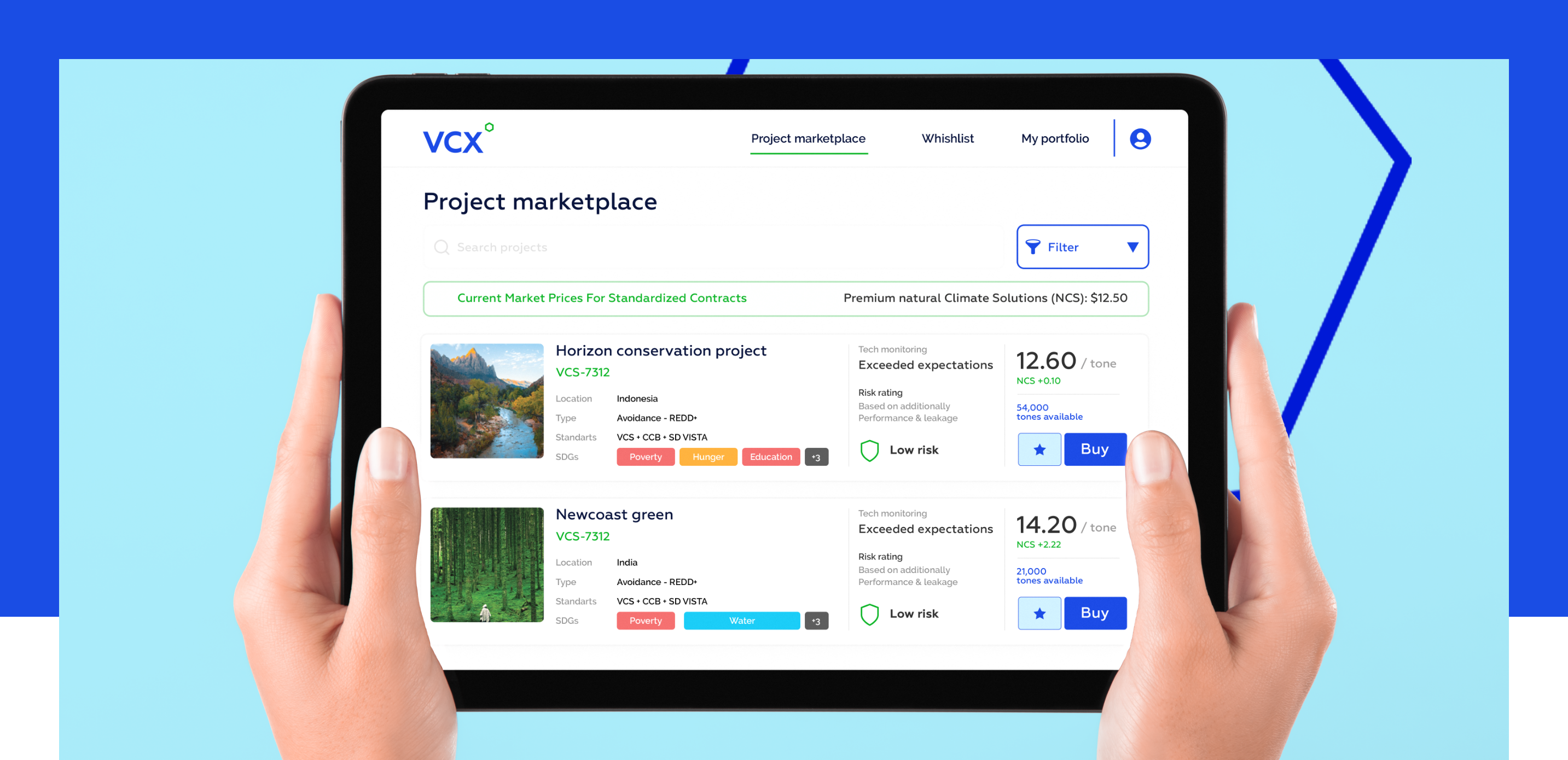

Invest into CO2 exchange

Investing in Carbon Offsets represents a direct contribution to the transition to a low-carbon dioxide economy. Supporting climate protection projects make a positive impact on our world and can gain substantial profits at the same time.

Locations

Registered Office

124 City Road,

London EC1V 2NX

London

The South Quay Building

189 Marsh Road

Canary Wharf

London E14 9SH

Budapest

Metro Capital Bank

Magyarországi Fióktelepe

1111 Budapest, Lágymányosi utca 12. fszt. 2

Become a shareholder

Become a shareholder to enjoy the full benefits of Metro Capital Bank’s broad range of services.